do you pay taxes when you sell a car in illinois

To transfer your license plates after you sell your car in Illinois you will need to submit an Application for Vehicle Transaction s Form VSD 190 to the IL SOS in person. It starts at 390 for.

The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue.

. For example sellers in Park Ridge pay a transfer tax of just 2 per every 1000 of value while sellers in Oak. DMV or State Fees. Cost of Buying a.

It starts at 390 for. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. Who pays sales tax when selling a car privately in Illinois.

Who Pays Sales Tax When Selling a Car Privately in Illinois. Who Pays Sales Tax When Selling a Car Privately in Illinois. Youll need to have the title sales.

The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. Income Tax Liability When Selling Your Used Car. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue.

When an Illinois resident purchases a vehicle from an out-of-state dealer and will title the car in Illinois the sale and subsequent tax due is reported on Form RUT-25 when you bring the. Unless of course you. Selling a car for more than you have invested in it is considered a capital gain.

Calculate Car Sales Tax in Illinois Example. If you sell a vehicle to a. Sometimes even if you sell the car for a little more than its actual value you dont have to pay tax for it.

Who pays sales tax when selling a car privately in Illinois. What is the Sales Tax on a Car in Illinois. Since the Missouri tax appears to be 4225 and the standard Illinois tax on vehicle sales is 625 you must pay the 2025 difference.

Selling a car for a profit If you sold your vehicle for more than what you. As a result of this decision the Ministry of Finance adopted the position that all incentives to factories are. For vehicles worth less than.

Use the Illinois Tax Rate Finderto find. Thus you have to pay. 21 hours agoIt depends on where in Illinois the property you are selling is located.

Thats 2025 per 1000. You do not need to pay sales tax when you are selling the vehicle. For example if you purchased a used car from a family member for 1000 and later sold it for 4000 you will need to pay taxes on the profit.

For vehicles worth less than. Sometimes even if you sell the car for a little more than its actual value you dont have to pay tax for it. The amount that you have to pay for your Illinois used car sales tax or your Illinois new car sales tax depends on what city you live in.

Vehicle sales tax for vehicles sold by a dealer Usually 625 but can vary by location. When you sell a car for more than it is worth you do have to pay taxes. Here are typical fees in Illinois.

However you wont need to pay the tax. For vehicles worth less than 15000 the tax is based on the age of the vehicle. Sales taxes in Illinois are calculated before rebates are applied so the buyer who pays 9500 after a 2500 rebate will still pay sales tax on the full 12000.

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Louisiana Car Sales Tax Everything You Need To Know

States With The Highest Lowest Tax Rates

How To Pay Illinois Sales Tax Online 9 Steps With Pictures

What Is Illinois Car Sales Tax

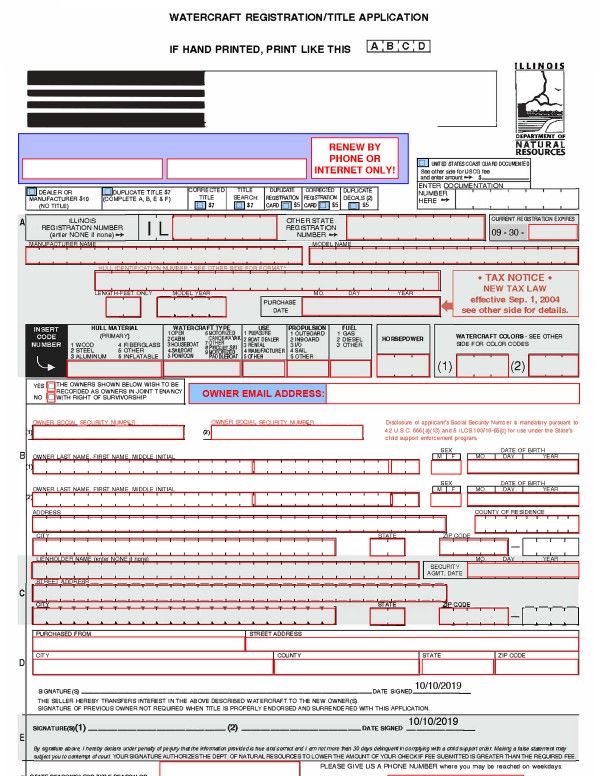

Illinois Bill Of Sale Forms And Registration Requirements

How Do State And Local Sales Taxes Work Tax Policy Center

Used Cars In Illinois For Sale Enterprise Car Sales

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Illinois Sales Use Tax Guide Avalara

What To Know About Taxes When You Sell A Vehicle Carvana Blog

Illinois Local Tax Changes For Out Of State Remote Sellers

Can You Drive A Car Without Plates When You Buy It In Illinois

Do Dealerships Register New Or Used Cars For You Capital One Auto Navigator

How To Transfer A Vehicle Title In Illinois Dmv Connect

What Is Illinois Car Sales Tax

What Small Business Owners Need To Know About Sales Tax

Updates To The 2022 Illinois Trade In Tax Credit Castle Chevrolet